In an inspiring real-life incident, a man from Chandigarh, India, discovered old physical share certificates of Reliance Industries Limited (RIL) purchased 37 years ago. What was once a modest ₹30 investment has now grown to a staggering ₹12 lakh, thanks to stock splits, bonus shares, and the power of compounding. This story has sparked curiosity across India, encouraging many people to dig through old documents to check if they too might be sitting on hidden wealth.

Forgotten ₹30 Reliance Shares Turn Into ₹12 Lakh Jackpot

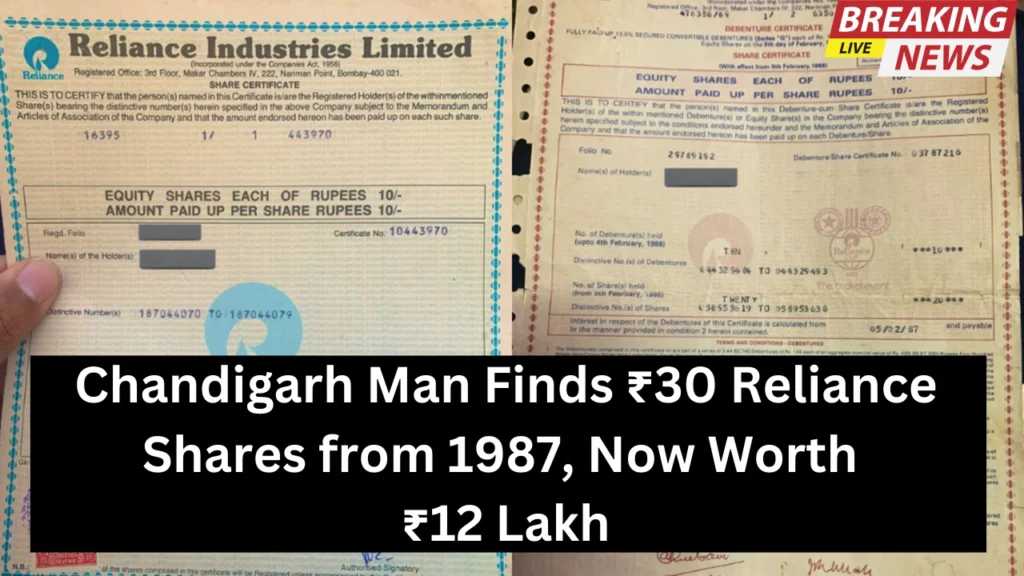

Rattan Dhillon, a rally driver and auto enthusiast from Chandigarh, was going through old files when he stumbled upon two Reliance share certificates from February 1987 and December 1992, representing a total of 30 shares — 20 and 10 shares respectively — each purchased at ₹10.

Due to corporate actions over the decades, these 30 shares had multiplied to 960 shares. Given that RIL stock is trading around ₹1250, the value of his old investment now stands at a whopping ₹12 lakh.

How Did His ₹30 Grow into ₹12 Lakh?

Here’s a breakdown of how his investment grew:

| Investment Details | Value/Status |

|---|---|

| Year of Purchase | 1987 & 1992 |

| Original Amount | ₹30 |

| Company | Reliance Industries Limited (RIL) |

| Corporate Actions | 3 Stock Splits, 2 Bonus Issues |

| Final Share Count | 960 shares |

| Current Share Price | ₹1250 (approx.) |

| Current Value | ₹12,00,000 |

Why It Grew:

- Stock Splits: Shares were split into smaller parts, increasing quantity.

- Bonus Shares: Free shares issued to existing shareholders.

- Dividends: Unclaimed dividends may also be recoverable.

- Long-Term Growth: RIL is among the most valuable companies in India, led by Mukesh Ambani.

Found Old Share Certificates? Here’s What You Should Do

If you, or someone in your family, have old share certificates, follow these 4 steps to find their value and claim your assets.

Step 1: Check If Shares Are Still in Your Name

- Visit the IEPF website: www.iepf.gov.in

- Use the IEPF Search Facility to check if your shares were transferred to the Investor Education and Protection Fund.

- If results are not found, reach out to the company registrar or your Depository Participant (DP).

Step 2: Dematerialize (Convert to Digital Format)

- Open a Demat Account with brokers like Zerodha, Groww, or Upstox.

- Submit KYC documents: PAN card, Aadhaar, cancelled cheque.

- Fill out the Demat Request Form (DRF) and submit it with the original share certificates.

Step 3: Claim Unpaid Dividends via IEPF

- If dividends were unclaimed for 7+ years, they go to IEPF.

- Fill Form IEPF-5 on the IEPF portal.

- Attach ID proof, share certificate copies, and submit to the Nodal Officer of the company.

Step 4: Update Nominee Details

- Add nominees in your Demat and bank accounts.

- Inform your family about your investments to avoid future losses.

Track & Manage Your Investments Efficiently

To avoid forgetting investments like Rattan Dhillon did, use these simple tools and tips:

Use Online Platforms

- Apps like Zerodha, Groww, 5paisa, and ICICI Direct let you monitor your portfolio in real-time.

- Save digital copies of your investment proofs.

Keep a Yearly Check

- Review stock performance, bonuses, and splits at least once a year.

- Set reminders in Google Calendar or use apps like MoneyControl for alerts.

Subscribe to Market News

- Follow platforms like Economic Times, Moneycontrol, and Bloomberg Quint.

- Stay updated on company actions.

Social Media Reacts: ‘Lottery Lag Gayi Bhai!’

After posting the pictures of the certificates on X (formerly Twitter), user @ShivrattanDhil1 received thousands of reactions.

- “Lottery lag gayi apki!” wrote one amused user.

- Another suggested: “Don’t demat now, you’ll be tempted to sell. Hold for more growth!”

- A third joked: “Search for MRF shares too, Rattan bhai!”

Even Zerodha and IEPFA responded, offering to help him verify and reclaim his shares. IEPFA asked him to provide his folio number and contact details after he reported no result via their portal.

Frequently Asked Questions

How do I check if I have forgotten shares?

Visit the IEPF portal and use their search function. You can also consult your stock broker or registrar.

Can I claim shares transferred to IEPF?

Yes. File Form IEPF-5 and submit necessary proofs to get them back.

Can I sell my old physical shares directly?

No. You must dematerialize them through a DP first before selling.

What if my shares are not listed in IEPF?

Contact the company’s registrar with the certificate and investor details.

How to prevent such situations?

Maintain updated digital records, assign nominees, and review your investments annually.

Final Takeaway

This story is a wake-up call for everyone. That one ₹30 investment in 1987 turned into ₹12 lakh in 2024, proving the magic of compounding and long-term investing.

If you’ve inherited old files from your parents or grandparents, check for physical share certificates from companies like Reliance, Tata, HUL, MRF, or Infosys. You might just be sitting on a fortune.

So go ahead, dig into those old cupboards — your own financial jackpot might be waiting to be discovered!